Published By: Tarrence Sun | 10/14/2024

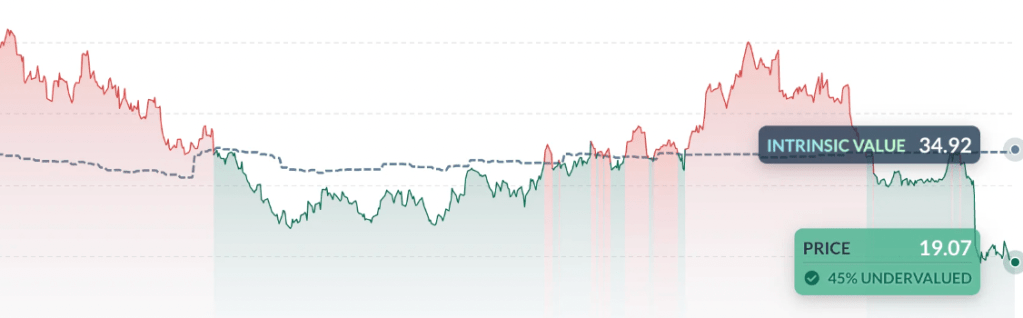

I just bought $1,000 of Intel (NASDAQ: INTC), and I firmly believe it’s one of the best decisions I’ve made in the market recently. The stock is undervalued, overlooked, and primed for a major comeback. While others chase the latest shiny names like NVIDIA and AMD, I’m betting on Intel for one simple reason: the market is wrong about this company, and I’m here to take advantage of it. I’ve invested $1,000 into Intel because I am convinced that this company is grossly undervalued—and when the market finally wakes up, those who acted early will see substantial gains. This investment is a no-brainer if you’re willing to go against the grain. With the lack of innovation from other giants, I see Intel as the last one ready to soar, and I’m eager to catch its wings.

Intel Is a Cash Machine, and the Market’s Sleeping on It

Intel is sitting on $28 billion in cash and still dominates key segments like PCs and servers. Yet, the market is treating it as if it’s already dead in the water. Digging into the financials reveals enormous cash flow and a rock-solid balance sheet. They’re generating billions in profit, yet the stock is priced as if it’s on life support. This disconnect between Intel’s fundamentals and its stock price creates an opportunity that’s too good to ignore.

I refuse to believe Intel is dead. The market has overreacted to its recent stumbles, creating glaring opportunities. Intel still controls a massive portion of the global chip market, and its balance sheet is robust. While others chase the hype, I’m seizing the chance to buy Intel at a price that simply doesn’t reflect its true value.

The Qualcomm Takeover Rumor: A Wake-Up Call for Everyone Else

I didn’t need Qualcomm to confirm my belief in Intel, but let’s be honest—this takeover rumor is exactly what Intel needs to wake people up. Qualcomm’s interest in acquiring Intel sends a clear message: there’s something big brewing at Intel. If Qualcomm, a major player in its own right, sees Intel as worth acquiring, why isn’t the market catching on?

This could be a massive catalyst. If a deal goes through, Intel’s stock will shoot up overnight. Even if it doesn’t happen, the mere fact that Qualcomm is considering this move should make every Intel doubter think twice. I’m not investing in Intel because of a possible acquisition; I’m investing because Intel is undervalued on its own merits. But if Qualcomm steps in, that’s a bonus that will amplify my returns. Either way, the market will soon be forced to reassess how they view Intel, and I’m positioning myself to take full advantage.

Intel and AWS: A Partnership That Will Drive the Future

Everyone’s buzzing about AI, but they’re overlooking Intel’s multi-billion dollar partnership with Amazon Web Services (AWS). This is monumental. Intel is supplying AWS with custom Xeon chips and cutting-edge AI hardware. The infrastructure behind AI is often forgotten, and Intel is integral to building that foundation.

With this deal, Intel is firmly placing itself in the heart of the AI and cloud computing revolution. AWS is the largest cloud provider globally, and they’re not partnering with Intel out of charity. This collaboration is akin to Apple partnering with TSMC. They know Intel can deliver, and so do I. This partnership will generate substantial revenue for Intel, but more importantly, it proves that Intel is far from irrelevant in the future of tech. Intel is the backbone of computing power, and it is strategically positioning itself to dominate that space.

Government Backing: Intel’s Safety Net and Growth Booster

The U.S. government has recognized semiconductors as a key national security issue, and Intel is the American company best positioned to benefit from this shift. With $8.5 billion in government subsidies and $11 billion in loans earmarked for enhancing its chip-making capabilities in the U.S., Intel is on solid ground. This is critical. As the U.S. looks to reduce its reliance on foreign chipmakers like Taiwan Semiconductor, Intel stands ready to lead the charge in building a domestic supply chain.

For me, this government backing signifies growth potential with limited downside risk. Intel isn’t some small startup struggling to survive. It’s a company that the government will ensure remains viable because it’s essential to the nation’s technological infrastructure. I’m not worried about Intel going under; it’s too important to fail. This government support equips Intel with the resources it needs to expand, innovate, and eventually reclaim its leadership position in the global chip market.

Intel’s Innovation Pipeline: Don’t Sleep on Their Comeback

Intel’s fall from grace isn’t a secret, but the company isn’t rolling over—far from it. Intel is forging ahead with major innovations that the market is seriously underestimating. Its 18A node CPUs are set to launch in 2025, and they’ll likely blow AMD and TSMC out of the water. These chips promise a significant leap in performance, and Intel is investing heavily to ensure a successful rollout.

Moreover, Intel’s Arrow Lake processors are poised to redefine standards in both the PC and server markets. These advancements could help Intel reclaim its spot at the top. But guess what? The market isn’t factoring this in; they’re too fixated on Intel’s past mistakes to recognize the shifting landscape. This is why I’m bullish—Intel is innovating, and when these chips hit the market, the narrative will shift. By then, Intel’s stock will no longer be the “cheap” buy it is today.

Intel Is a No-Brainer Buy Right Now

Here’s the bottom line: Intel is undervalued, overlooked, and mispriced by a market too focused on short-term trends and hype stocks. I didn’t invest $1,000 in Intel because it’s a hot stock or because I’m chasing trends. I’m in this for the long haul because I see a company with deep financial resources, government backing, strategic partnerships, and a clear path to future growth that’s being ignored. The market is wrong about Intel, and the Qualcomm takeover rumors are just icing on the cake.

With Intel’s stock trading at such a discount, I see an opportunity that most people miss. This isn’t a gamble—it’s a calculated investment in a company poised to prove everyone wrong. When that happens, those with the foresight to invest early—while the stock is still being written off—will reap substantial rewards. I’m in for $1,000 now, and if the market remains blind, I’ll gladly invest more. I’m not waiting for the market to tell me Intel’s worth buying. Don’t follow the herd; act decisively.

The market may be sleeping on Intel, but I’m wide awake.